There are three objectives: find something affordable, comfortable, and to find coverage you can qualify.

Final Expense

Simplified Issued Whole life insurance. Geared toward the 65 and older market place with smaller face amounts typically $5,000 to $25,000. These types of policies are not fully underwritten but rather quick issue with no parameds or aps’ . True guarantee issue plans are available.

Single Premium Final Expense

Simplified Issue permanent life insurance available to clients up to age 85. Clients with a lump sum as low as $5,000 can pay up a life insurance plan to help pay for burial expense and pass on wealth tax free. Geared towards the 60 and over market due to its simplified issue underwriting. No parameds or aps’ required.

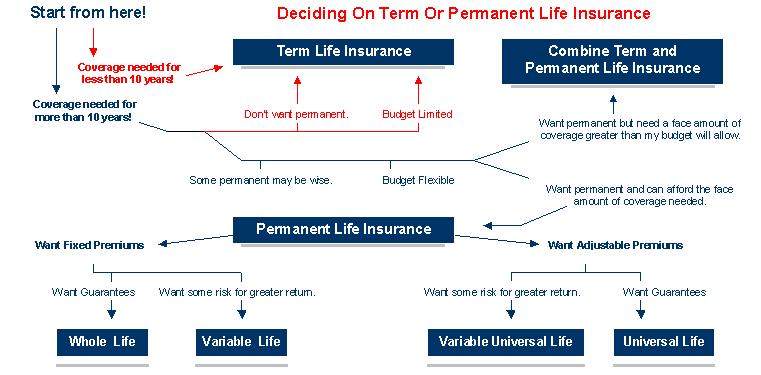

Whole Life

Simplified Issue permanent life insurance available to clients up to age 85. Clients with a lump sum as low as $5,000 can pay up a life insurance plan to help pay for burial expense and pass on wealth tax free. Geared towards the 60 and over market due to its simplified issue underwriting. No parameds or aps’ required.

Universal Life

Flexible premium life insurance that can be structured to meet the goals and budgets of clients. Cash value is an option with Universal Life. Premium payments can be structured from one year to lifetime.

Indexed universal Life

Similar in nature to traditional Universal Life Insurance. The biggest difference is how cash growth is accumulated. Instead of a stated interest rate cash grows based on the performance of a market index such as the S&P 500.

Term Life

Covers the client for a term typically 10 to 30 years. It does not build up any cash value. It is typically sold as cheap death benefit needed for a specific period of time.